Keynesian economics are the various macroeconomic theories and models of how aggregate demand strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. It is influenced by a host of factors that sometimes behave erratically and impact production, employment, and inflation.

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output/GDP and national income, unemployment, price indices and inflation, consumption, saving, investment, energy, international trade, and international finance.

The IS–LM model, or Hicks–Hansen model, is a two-dimensional macroeconomic model which is used as a pedagogical tool in macroeconomic teaching. The IS–LM model shows the relationship between interest rates and output in the short run in a closed economy. The intersection of the "investment–saving" (IS) and "liquidity preference–money supply" (LM) curves illustrates a "general equilibrium" where supposed simultaneous equilibria occur in both the goods and the money markets. The IS–LM model shows the importance of various demand shocks on output and consequently offers an explanation of changes in national income in the short run when prices are fixed or sticky. Hence, the model can be used as a tool to suggest potential levels for appropriate stabilisation policies. It is also used as a building block for the demand side of the economy in more comprehensive models like the AD–AS model.

Nicholas Kaldor, Baron Kaldor, born Káldor Miklós, was a Cambridge economist in the post-war period. He developed the "compensation" criteria called Kaldor–Hicks efficiency for welfare comparisons (1939), derived the cobweb model, and argued for certain regularities observable in economic growth, which are called Kaldor's growth laws. Kaldor worked alongside Gunnar Myrdal to develop the key concept Circular Cumulative Causation, a multicausal approach where the core variables and their linkages are delineated. Both Myrdal and Kaldor examine circular relationships, where the interdependencies between factors are relatively strong, and where variables interlink in the determination of major processes. Gunnar Myrdal got the concept from Knut Wicksell and developed it alongside Nicholas Kaldor when they worked together at the United Nations Economic Commission for Europe. Myrdal concentrated on the social provisioning aspect of development, while Kaldor concentrated on demand-supply relationships to the manufacturing sector. Kaldor also coined the term "convenience yield" related to commodity markets and the so-called theory of storage, which was initially developed by Holbrook Working.

Sir John Richard Hicks was a British economist. He is considered one of the most important and influential economists of the twentieth century. The most familiar of his many contributions in the field of economics were his statement of consumer demand theory in microeconomics, and the IS–LM model (1937), which summarised a Keynesian view of macroeconomics. His book Value and Capital (1939) significantly extended general-equilibrium and value theory. The compensated demand function is named the Hicksian demand function in memory of him.

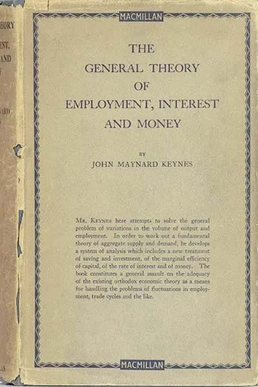

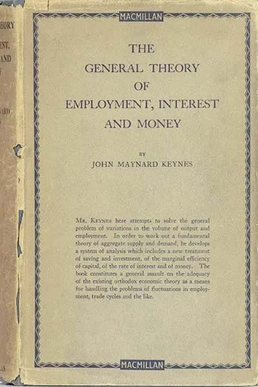

The General Theory of Employment, Interest and Money is a book by English economist John Maynard Keynes published in February 1936. It caused a profound shift in economic thought, giving macroeconomics a central place in economic theory and contributing much of its terminology – the "Keynesian Revolution". It had equally powerful consequences in economic policy, being interpreted as providing theoretical support for government spending in general, and for budgetary deficits, monetary intervention and counter-cyclical policies in particular. It is pervaded with an air of mistrust for the rationality of free-market decision making.

In economics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the demand for the gross domestic product of a country. It specifies the amount of goods and services that will be purchased at all possible price levels. Consumer spending, investment, corporate and government expenditure, and net exports make up the aggregate demand.

A liquidity trap is a situation, described in Keynesian economics, in which, "after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers holding cash rather than holding a debt which yields so low a rate of interest."

In economics, the Pigou effect is the stimulation of output and employment caused by increasing consumption due to a rise in real balances of wealth, particularly during deflation. The term was named after Arthur Cecil Pigou by Don Patinkin in 1948.

The paradox of thrift is a paradox of economics. The paradox states that an increase in autonomous saving leads to a decrease in aggregate demand and thus a decrease in gross output which will in turn lower total saving. The paradox is, narrowly speaking, that total saving may fall because of individuals' attempts to increase their saving, and, broadly speaking, that increase in saving may be harmful to an economy. The paradox of thrift is an example of the fallacy of composition, the idea that what is true of the parts must always be true of the whole. The narrow claim transparently contradicts the fallacy, and the broad one does so by implication, because while individual thrift is generally averred to be good for the individual, the paradox of thrift holds that collective thrift may be bad for the economy.

In macroeconomic theory, liquidity preference is the demand for money, considered as liquidity. The concept was first developed by John Maynard Keynes in his book The General Theory of Employment, Interest and Money (1936) to explain determination of the interest rate by the supply and demand for money. The demand for money as an asset was theorized to depend on the interest foregone by not holding bonds. Interest rates, he argues, cannot be a reward for saving as such because, if a person hoards his savings in cash, keeping it under his mattress say, he will receive no interest, although he has nevertheless refrained from consuming all his current income. Instead of a reward for saving, interest, in the Keynesian analysis, is a reward for parting with liquidity. According to Keynes, money is the most liquid asset. Liquidity is an attribute to an asset. The more quickly an asset is converted into money the more liquid it is said to be.

Alvin Harvey Hansen was an American economist who taught at the University of Minnesota and was later a chair professor of economics at Harvard University. Often referred to as "the American Keynes", he was a widely read popular author on economic issues, and an influential advisor to the government on economic policy. Hansen helped create the Council of Economic Advisors and the Social Security system. He is best remembered today for introducing Keynesian economics in the United States in the 1930s and 40s.

In monetary economics, the demand for money is the desired holding of financial assets in the form of money: that is, cash or bank deposits rather than investments. It can refer to the demand for money narrowly defined as M1, or for money in the broader sense of M2 or M3.

The neoclassical synthesis (NCS), neoclassical–Keynesian synthesis, or just neo-Keynesianism was a neoclassical economics academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Keynes in his book The General Theory of Employment, Interest and Money (1936). It was formulated most notably by John Hicks (1937), Franco Modigliani (1944), and Paul Samuelson (1948), who dominated economics in the post-war period and formed the mainstream of macroeconomic thought in the 1950s, 60s, and 70s.

The Keynesian cross diagram is a formulation of the central ideas in Keynes' General Theory of Employment, Interest and Money. It first appeared as a central component of macroeconomic theory as it was taught by Paul Samuelson in his textbook, Economics: An Introductory Analysis. The Keynesian cross plots aggregate income and planned total spending or aggregate expenditure.

In economics, the loanable funds doctrine is a theory of the market interest rate. According to this approach, the interest rate is determined by the demand for and supply of loanable funds. The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits.

Macroeconomic theory has its origins in the study of business cycles and monetary theory. In general, early theorists believed monetary factors could not affect real factors such as real output. John Maynard Keynes attacked some of these "classical" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual, microeconomic parts. Attempting to explain unemployment and recessions, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that markets always clear, leaving no surplus of goods and no willing labor left idle.

The Cambridge equation formally represents the Cambridge cash-balance theory, an alternative approach to the classical quantity theory of money. Both quantity theories, Cambridge and classical, attempt to express a relationship among the amount of goods produced, the price level, amounts of money, and how money moves. The Cambridge equation focuses on money demand instead of money supply. The theories also differ in explaining the movement of money: In the classical version, associated with Irving Fisher, money moves at a fixed rate and serves only as a medium of exchange while in the Cambridge approach money acts as a store of value and its movement depends on the desirability of holding cash.

The wage unit is a unit of measurement for monetary quantities introduced by Keynes in his 1936 book The General Theory of Employment, Interest and Money. A value expressed in wage units is equal to its price in money units divided by the wage of a man-hour of labour.

Keynes's theory of wages and prices is contained in the three chapters 19-21 comprising Book V of The General Theory of Employment, Interest and Money. Keynes, contrary to the mainstream economists of his time, argued that capitalist economies were not inherently self-correcting. Wages and prices were "sticky", in that they were not flexible enough to respond efficiently to market demand. An economic depression for instance, would not necessarily set off a chain of events leading back to full employment and higher wages. Keynes believed that government action was necessary for the economy to recover.